Many consumers prefer to pay large bills in installments through ACH payments rather than a credit card. Offering this option in your business will decrease consumer complaints and increase your overall receivables. But just as with cards, it’s important to ensure the recurring ACH payments you accept are compliant.

Understanding Recurring ACH Payment Compliance

What is Nacha?

Nacha governs the ACH network, the payment system that drives Direct Deposits and Direct payments.

Nacha develops the rules that allow Direct Deposits and ACH bill payments.

It is important to comply with payment regulations. After all, these rules are created to keep consumers safe during business transactions. Neglecting to comply opens your business to liability, consumer complaints and account shut-offs – all outcomes that could negatively impact your organization.

Compliance guidance for recurring ACH payments comes from Nacha and the Electronic Fund Transfer Act’s Regulation E.

NACHA

Regulation E

What is the Electronic Funds Transfer Act?

The Electronic Funds Transfer Act (EFTA) (15 USC 1693 et seq.) of 1978 is intended to protect individual consumers engaging in electronic funds transfers (EFTs).

EFT services include transfers through automated teller machines, point-of-sale terminals, automated clearinghouse systems, telephone bill-payment plans in which periodic or recurring transfers are completed, and remote banking programs.

How to Keep ACH Recurring Billing Compliant

Basic Components Of Compliance

- Call authorization scripts - Create call authorization scripts for employees to use when setting up schedules by telephone. Following these scripts will ensure compliance on every transaction.

- Revocation language - Provide revocation language for consumers, so they can understand the rights they have to revoke recurring ACH payment authorization for a payment schedule.

- Call recording ability - Depending upon the transaction type used for the ACH payment, you will need a recording of the authorization.

- Consumer identity verification - you must be able to verify the consumer for their protection and security.

- The ability for consumers to receive a receipt - you must be able to provide consumers with a receipt of the ACH transaction.

- Written authorization/wet signature - for many transaction types, a signed authorization of the recurring payment schedule is required to maintain compliance.

Sample Revocation Language

Payment Options: Channels And Methods

Whether a consumer pays by phone or online shouldn’t be your company’s only consideration. Debit and credit card payments come with different compliance concerns than ACH. Standardizing your practice across payment methods can benefit your business and keep all customer payments secure.

Debit Card - Debit card payments or cards that are linked to checking accounts, require a signed payment authorization form to withdraw recurring payments from an account.

Credit Card - Credit card payments with a signature authorization are not required, but are recommended for large transactions.

Because there are so many considerations when taking a payment, you may find it’s easier (for training purposes and for peace of mind) to standardize your company’s payment authorization practice.

Create a payment workflow that will fulfill compliance by requiring signatures before payment and perform every payment this same way.

This will make the process easier and more automatic for front-line staff, decreasing the chance of human error. Accepting a signature for every payment also decreases ACH returns and creates greater consumer trust in your business.

How PDCflow Can Help

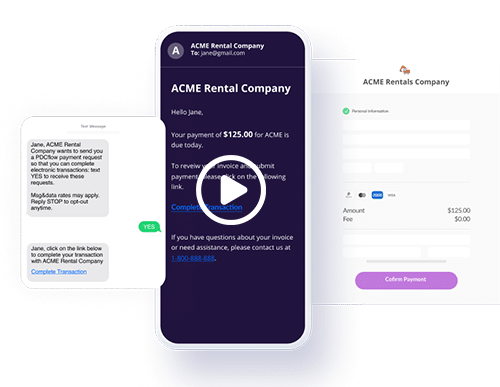

We’ve developed our payment software to help businesses and accounts receivable teams easily follow payment regulations. We offer:

- revocation language directly on payment pages

- dual authentication measures to verify consumer identity

- the ability to automatically send receipts to consumers

PDCflow’s Flow Technology makes payment security and compliance quick and easy.

Sending payment schedules and receiving recurring ACH payment authorization forms in the same workflow cuts down on time between schedule creation and the time of the first payment. This brings revenue into your business as fast as possible.

For more information on how PDCflow can help your business stay compliant while creating a great payment experience for your customers, speak with a PDCflow payment expert today.