Top Down Negotiation

Top down negotiation is a simple strategy that can help any agent increase their numbers if they learn to use it properly. Top down means starting every conversation asking for payment in full. This expectation leaves plenty of room to work down to a mutually agreeable payment amount.

In negotiation, it’s easier to work your way down to a lower number than to ask a consumer to pay a higher amount later in the call. This technique sounds simple, but can be difficult in practice if your customer already has an amount in mind. Training should include tactics to redirect conversations to maintain control of the call.

Better Recurring Payment Plans

Agents often fall into the trap of agreeing to unfavorable recurring payment plans. Don’t let consumers set long-term, low dollar schedules that don’t bring you any money. There are a few basic strategies that can improve recovery rates when you are discussing payment plan options.

- Higher monthly payments - When offering recurring billing schedules to consumers, some of the guesswork comes in finding out how much they can afford per payment. Once you understand where their threshold is, consider suggesting $10 or $15 more per payment. Oftentimes, consumers are willing to pay a few more dollars, knowing this will shorten the payment length.

- Shorter schedules - Another useful tactic is to suggest higher dollar, short-term payment schedules. Offering a three to six month plan can help consumers buy in and become motivated to pay off their overdue bill.

- Down payments - Those who have already made a substantial payment on their account are more likely to be invested in making monthly payments. Suggest to consumers they pay a larger one-time payment today, securing some revenue and keeping them interested in completing their recurring schedule.

- Don’t acknowledge the minimum acceptable payment - Customers asking about the minimum payment they can make can disrupt the flow of the call. Teach agents not to discuss the lowest acceptable payment. If they do so, it will be much harder to rise above that number throughout the call.

To offer consumers the best experience possible setting up payment plans, ensure you’re using a payment software like PDCflow that provides the payment security and compliance features you need.

Teach Agents to Have a Better Call

Another vital part of negotiation is knowing how to guide consumers gently through a conversation. Those owing money (especially once a bill is overdue) may find it difficult to focus on resolution. Teach agents how to show empathy, refocus conversations and have a better call.

- Positive language - Positive language is a vital part of any accounts receivable call. Cutting negative language from conversations will automatically make consumers more receptive to a better payment arrangement.

- Conversational intelligence - Another vital part of negotiation is understanding privacy and compliance issues that come along with collecting bills (especially in healthcare collections). Train agents how to understand what is – and is not– appropriate to ask. Respectful, knowledgeable agents will put consumers at ease to be more honest about their financial situations.

- Overcoming stalls and objections - Payment stalls and objections can derail negotiations fast. Preparing agents with tactics for overcoming stalls and objections will keep them in control of calls.

- Empathy - Financial stress or other life changing circumstances can arise after goods and services were delivered, before a bill is due. Emphasize the importance of being empathetic with consumers. Teach front line staff to identify those who are able to pay bills right away and those who may need to hear other options.

Set Agents Up For Success

If you want agents to become better negotiators while keeping all other best practices in mind, you need to help them succeed. Build trust in your company by maintaining an up-to-date digital strategy that shows consumers you are a legitimate, trustworthy business.

Especially in times of flux such as the current pandemic, collection policies and procedures can change rapidly. Regularly update your internal training materials and other reference books to reflect these changes. Staff needs to be trained on and have access to the latest information and industry strategies to do their best work.

Tools to Help You Follow Through

Call Scripts

Training Techniques

Software

A big part of securing a payment agreement is staying in control of calls. PDCflow payment software offers a variety of tools that make bill negotiations easier.

- FLOW Technology for payment collection - a continual struggle in AR is turning the promise of a payment into a guaranteed payment. FLOW Technology allows agents to send a payment request directly to a consumer’s mobile phone or email address. This way, agents can stay on the phone while a payment is completed to ensure it goes through.

- FLOW for compliance - It’s important to ensure that along with collecting payments, your staff are following payment security and compliance guidelines. FLOW Technology reduces PCI compliance requirements for agencies by allowing consumers to key in payment information, taking this sensitive data out of the hands of collectors.

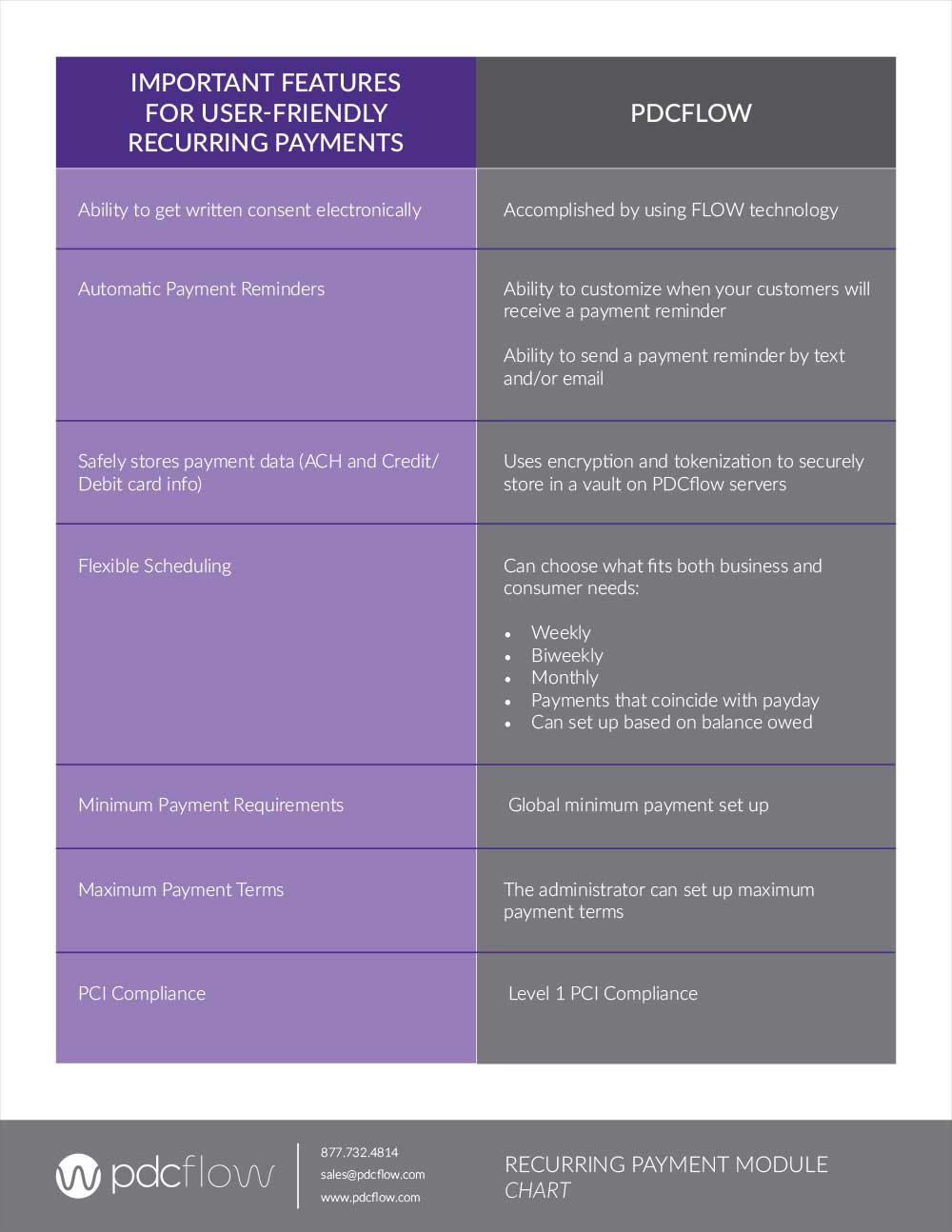

- PDCflow recurring payments - PDCflow’s recurring payment module allows for flexibility in plan frequency and administrators can control minimum payment amounts and maximum payment terms. This way, agents can offer the best payment plans possible to consumers while avoiding the low dollar, long term trap that reduces revenue.

Keeping control of calls and maintaining compliance once payment is agreed upon are essential to negotiation. To learn more about how FLOW Technology makes collection calls easier while keeping your call center compliant, download our solution brief.