In today’s tightening economy, businesses that put customer experience and digital transformation as their top priorities will not only survive, but grow. This means catering to customers by giving them options they want – like text payments.

Text billing and other customer-centric tactics (user-friendly workflows, preferred communication channels) boost payments to improve your bottom line among younger customers.

Using New Communication Channels

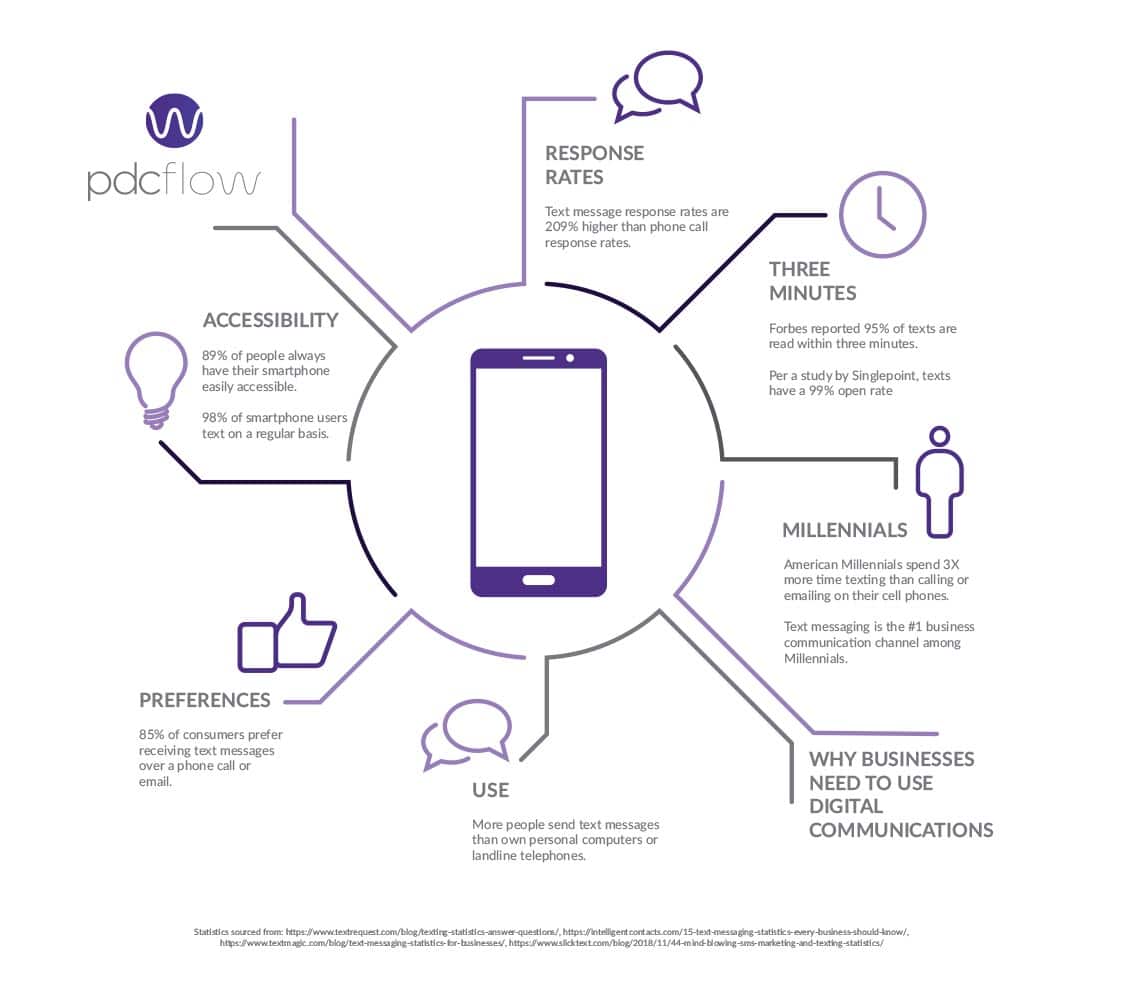

Millennials are the first generation to grow up with the internet and mobile phones. For younger consumers, digital communication tools are part of life. And they’re not the only ones.

Since the pandemic, most people have gotten used to (and prefer) using text, email, QR codes and other digital means of communication.

Why communicate and accept payments by text?

Reaching customers the way they want is good for business. Organizations should take advantage of the current technology trends to enhance the digital customer journey. Sending statements directly to a customer’s mobile phone and encouraging them to make a text payments is:

- Accessible - Nearly everyone carries their phone at all times. Accounts receivable departments can take advantage of this easy access to reach consumers instantly while a transaction is fresh in their minds.

- Fast - Most text messages are read and replied to within minutes. Paperless software options replace traditional paperwork tactics like snail mail, drastically decreasing time spent waiting on business documents, signatures or payments.

- Preferred - Consumers vastly prefer receiving a payment reminder text to a phone call. Changing from a payment reminder phone call to a payment reminder text message will show your customers you understand them. You’re also much more likely to receive a prompt response.

User-Friendly Text Payment Workflows

Companies should maximize customer convenience with payment processing software that uses text and email communication. Offer easy-to-navigate SMS payment workflows and more customers will pay on the first attempt. This eliminates nagging follow-up calls, reduces incoming customer service requests and streamlines payment workflows.

Texting also re-engages more people who have stopped responding to mailed invoices or phone calls without being intrusive. Incorporate text payment workflows into your accounts receivable process by:

- Sending contracts to be signed and returned digitally, so customers can move on to the next stage of the sales process.

- Sending invoices with text payment links directly to mobile phone numbers, so people can review charges and pay, all from a single text message.

- Scheduling reminder texts for due or overdue payments, to keep payments timely and satisfy payment regulations.

- Sending text payment links or documents during a customer service phone call. Give customers instant access to review information and pay their bills while on the phone with an agent.

How to Incorporate Text Messaging into Business Operations

Send contracts and promise to pay for a digital signature.

Send invoices with payment links directly to mobile devices.

Send payment reminder texts for due or overdue payments.

Send payment forms directly to customers to complete a payment while on the phone with agents.

Customer Satisfaction and Text Payments

Every interaction with a customer can become an online review. Customers who want fast processes don’t usually want to talk to an agent, navigate a complicated phone system – or worse, mail a check – just to make a payment.

If you make the process slow, difficult or annoying to customers, they won’t be happy. Some people may speak to your company directly. Many others will just leave a negative comment online.

Text payment reminders and text payment links offer a positive payment experience that encourages good reviews through:

- Speed - People appreciate a simple billing and payment process. The faster an unpaid bill can be resolved through a text payment, the more satisfied customers will be.

- Convenience - Convenience is always a top concern in customer service. Resolving bills the way consumers prefer is an easy way to meet their needs.

- Security - People don’t want to worry about stolen payment data every time they pay a bill. Letting customers put in their own information through a payment form puts customers at ease knowing their information is secure.

Use Cases

MEDICAL BILLING

Payments in the medical industry are changing. High deductible healthcare plans mean a large portion of bills must be paid by the consumer, not an insurance company. Consumers who prefer digital billing and text payments expect these conveniences to be available for healthcare costs too.

A text message payment system can be incorporated in the revenue cycle to improve more than just a final bill payment. Text messages improve the overall patient financial experience. Texting in healthcare can be used to:

- Request a secure photo upload of a patient’s insurance card to put on file before a visit.

- Send intake forms to new patients, so they can fill them out before the first visit.

- Take a copay through text payment, even in the same workflow with a photo upload and intake form.

CONSUMER SERVICES

Businesses that offer service before collecting payment often experience late payments (or no payment at all) for work that has been completed. In addition, some companies lose out on business before a contract is signed if there is too much friction during sales and onboarding.

Does your office require paper contracts to be signed in person or mailed back? Do you expect customers to print, sign, scan and email documents back for them to be legally binding? Do you have two separate workflows for capturing a contract signature and getting a down payment?

If your organization uses any of these tactics, your process will not attract younger generations or other customers who need fast, digital options. Send contracts and a down payment request together through text message to capture and retain a larger customer base.

DEBT COLLECTION

Every entity that accepts electronic fund transfers (EFTs) – like online ACH or bank card payments – needs to comply with Regulation E. Usually for companies, this means they need permission from the consumer before running a transaction.

For debt collection agencies (especially those that collect on large debts like medical debt) accounts need to be repaid through a recurring payment schedule instead of a lump sum. This means agents need to capture a consumer authorization before taking the first payment.

Sending an overview of a payment schedule, along with a request for an esignature through text message:

- Makes it easy for customers to read, review and approve a payment schedule while still on the phone with an agent.

- Speeds up how quickly an agency receives approval to start taking payments.

- Provides a digital record of the signature to customers and for staff to recall at any time for reference.

PDCflow for Text Payments and Communication

PDCflow makes it easy to communicate with customers in the ways they prefer. Streamline workflows and get paid by text faster with Flow Technology. Accomplish all of the following in just a single text message:

- Deliver a document to your customer for them to review or keep for future reference.

- Ask customers to upload photos. Keep a copy of an ID or insurance card on file, ask for photos of damage for deposit or insurance purposes, etc.

- Request a legally binding digital signature, straight from a phone, without printing, scanning mailing or other points of friction.

- Send an invoice, contract, or other items and take a payment all in one text message request.

To learn more about the benefits of using PDCflow for digital signatures, sending documents, invoicing and to increase payments, request a demo from a PDCflow Payment Expert.

Request a Demo

Want to know more about PDCflow Software?

Press ▶️ to watch our explainer video

ONE-STEP PROCESS

Updated July 2023