Businesses want to make money. But how do you know if sales are good enough to keep your company profitable? There are many different financial reports organizations use to track performance. One of the most common–the profit and loss statement–lets companies:

- Monitor how the organization is performing and better understand profitability

- Assess expenses and profit trends

- Plan for future growth and reinvest in the business based on P&L data

What is a Profit and Loss Statement?

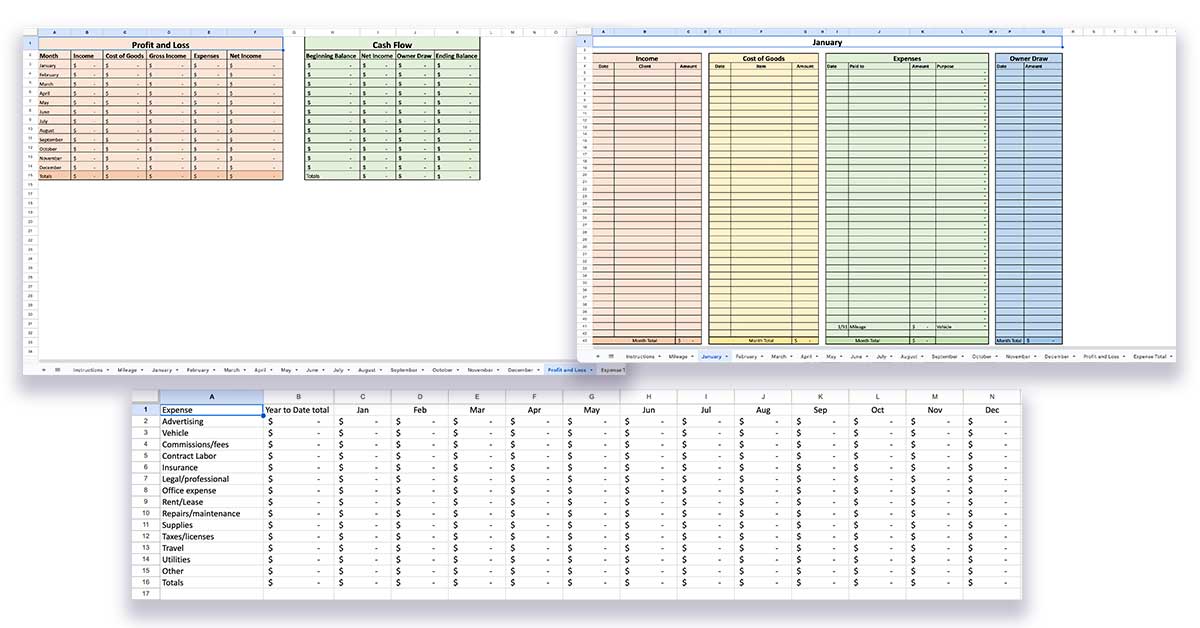

Profit and loss (P&L) statements are a type of report that tracks financial activity in a business for a specific period of time. Most people look at profit and loss statements monthly, quarterly or annually.

This type of financial report tracks both a company’s income and expenses and is usually calculated using a basic bookkeeping spreadsheet. This makes small business financial management easier and helps companies monitor:

- Revenue

- Expense trends within the organization

- Customer trends like seasonal spending

Profit and loss statements often calculate accrued revenue and expenses.

Using an accrual-based method, companies record sales that have been earned or expenses that have been incurred, even if the transactions aren’t fully processed.

For example, a utility bill your company owes but won’t pay until the due date should be recorded.

B2B payments may also apply. They are typically handled through an invoice with credit terms that give an extended time period to pay (net 30, 60, or 90 days are common).

If a customer has received the invoice, the sale was earned and you expect them to honor your payment terms. This sale should be counted as profit.

End late and non-payments

Only pay when you get paid

Capture, verify, and store customer payment info

Flow Billing

Components of a Profit and Loss Statement

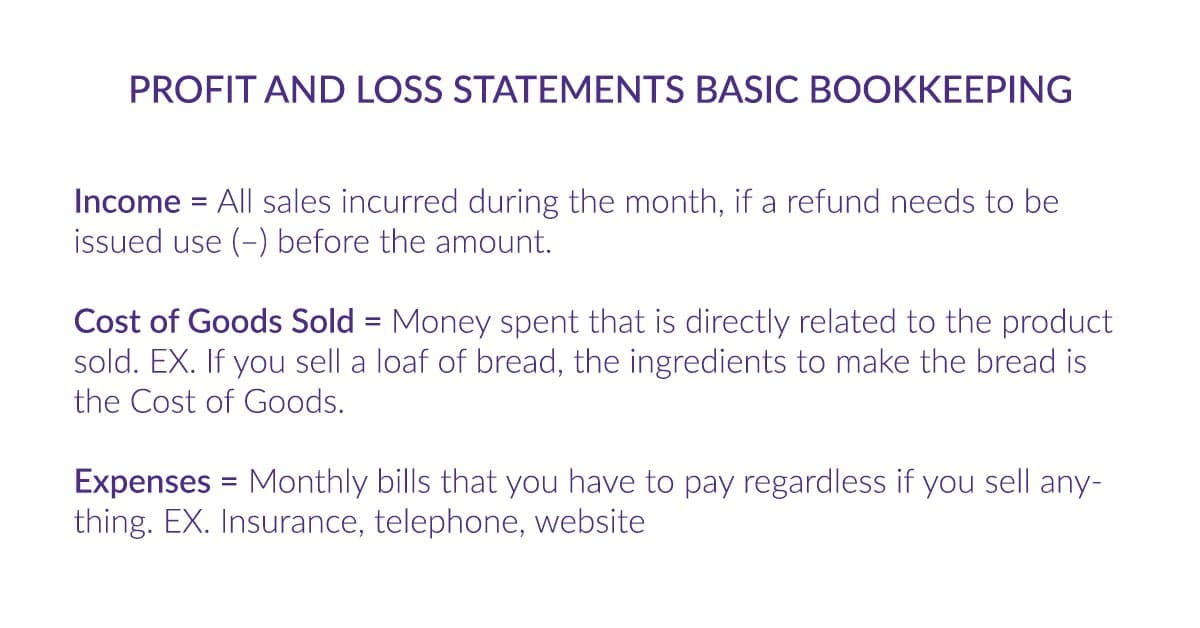

For those who want to manage a simple profit and loss statement, there are a few basic elements to include. These pieces of information will help your company find out how much money you are making compared to spending.

Revenue (income)

Without tracking sales, it would be impossible to understand how much money your company is bringing in. That’s why revenue is such an important element of a profit and loss statement.

Recording revenue also helps your company compare between sales periods to find patterns in customer spending, dips in profitability, etc.

When adding income to the P&L, make sure to report revenue from all sources. This could be sales from a storefront, retail locations, conventions, an online shop, or any other way your company brings in money.

Cost of goods sold (COGS)

It’s important to track the costs that go into providing your company’s goods or services (known as cost of goods sold or COGS). Any ingredients, materials or labor used to make a product or complete services should be carefully calculated.

Knowing the COGS can help you determine how much profit you are making from each sale and find areas of overspending on supplies.

Expenses

To know how much money you are making, you need to know how much you’re spending. Your profit and loss statement should list all expenses your organization paid during the time frame to remain operational, like:

- Payroll

- Equipment (both new purchases and maintenance costs)

- Marketing

- Rent

- Utilities

How is Profit (or Loss) Calculated?

There are a few different types of income calculated to find profit and loss: operating income (profit) and net profit. Calculating both can help companies compare where in the process they are beginning to make a profit or where losses are coming from.

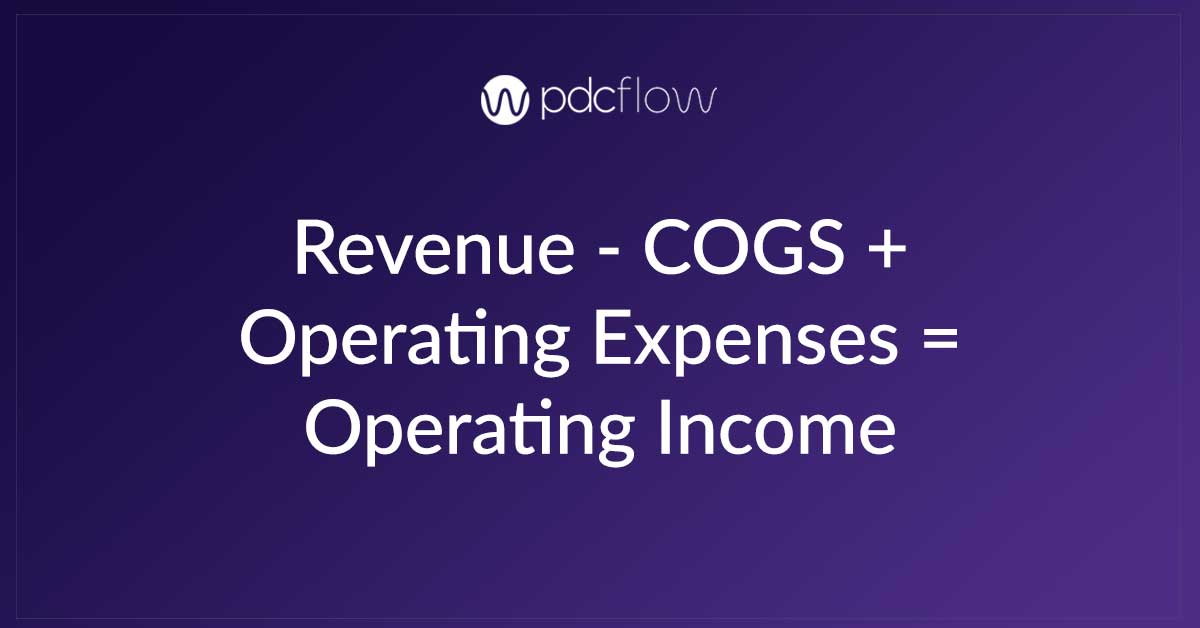

Operating Income (profit)

Operating income is the calculation of how much profit is made from sales, once COGS and expenses are subtracted.

Find operating income by calculating gross profit margin and subtracting COGS and operating expenses from that number.

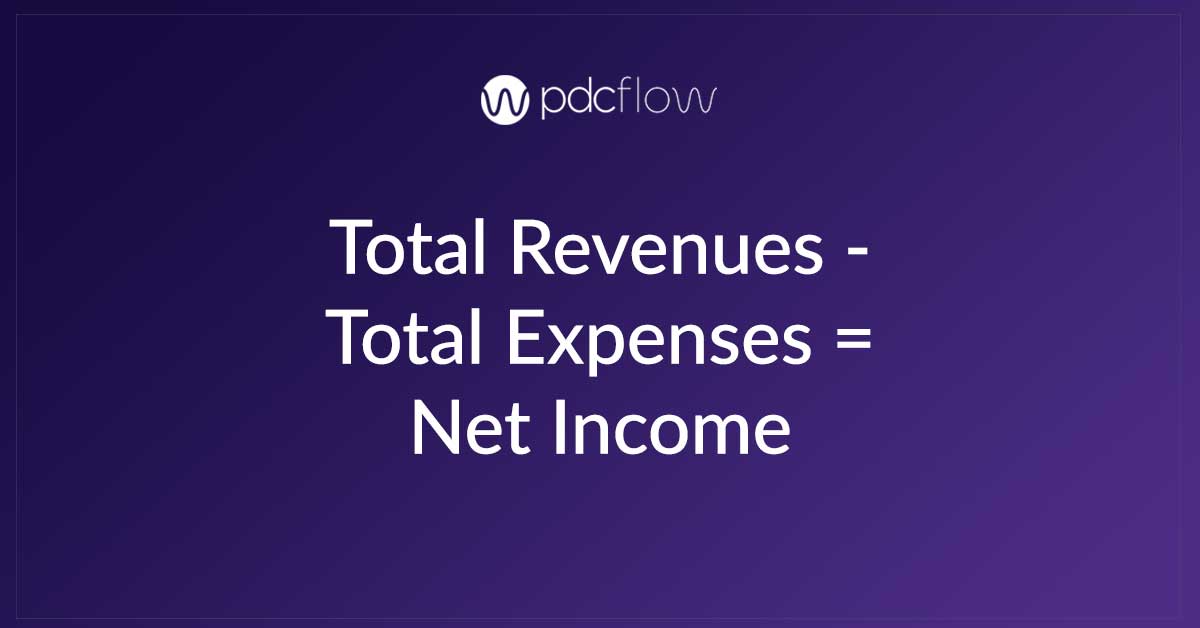

Net Profit

Net profits is when you want to know how much profit you’ve made (or money you’ve lost) after all other factors are accounted for. To find net profit, subtract expenses from total revenue. This includes taxes and interest.

P&L Statements For Planning and Growth

You can’t plan for the future if you don’t understand your current situation. Paying attention to your profit and loss statement is the best way to understand how healthy your organization is, where it’s effective, and where operations and expenses could be improved.

Someone in your company should be responsible for watching, analyzing and finding trends in your P&L and other financial management reports. This will help you reduce overhead, better understand your customers and plan for future growth.

Benchmarking

Companies can gain valuable insight by comparing their organization to others of the same industry, size, or those in a similar location. This comparison is also known as benchmarking. It can:

- Show businesses how well they are doing overall, compared to competitors

- Highlight areas of improvement, like lagging sales

- Help companies manage operating costs, by comparing rent, COGS or other expenses to other businesses.

The information you need for benchmarking can be hard to find. Small business associations often support benchmarking groups. Getting involved in the local business community is a good option for many small to medium-size companies.

Decision Making and Financial Planning

Profit and loss statements are essential to the financial future of every business. You can’t forecast future performance without reliable, current data.

Accountants and financial advisors also rely on this information to calculate taxes, help with forecasting and other financial reports and to give you advice.

If your company outsources some of your financial duties, it’s your responsibility to give these parties an accurate representation of your business.

Interacting With Stakeholders

Profit and loss statements are an essential source of information about your business. They tell the full story of your successes and opportunities as an organization. Companies can use P&L data to tell relevant parties how the business is performing.

You may need to share some insight about your profits and expenses to investors and partners, so they know you’re doing well. You may use expense information to assess what you’re paying vendors or suppliers and negotiate a better deal.

What is a Profit and Loss Write Off?

Most companies will have to write off unpaid invoices during the course of business. As part of an accurate profit and loss statement, you need to remove any of these invoices that you no longer plan on trying to collect.

Once you decide it’s not possible to collect a debt, you should no longer include that amount in your accounts receivable.

Reducing Unpaid Invoices

Every company is different, so there is no standard for when an unpaid invoice becomes a write-off. Before writing off bad debt, your company should take every step possible to collect the invoices in question. Some ways you can encourage payments are:

- Simple, low-friction payment workflows

- Self-serve options that are available 24/7

- Easy to reach customer service for those who prefer agent-assisted payments

For future operations and to grow your business, it’s important to collect payments on time. Not only does this have an impact on your bottom line, it will save countless hours of manual follow-up, just to write off debt in the end.

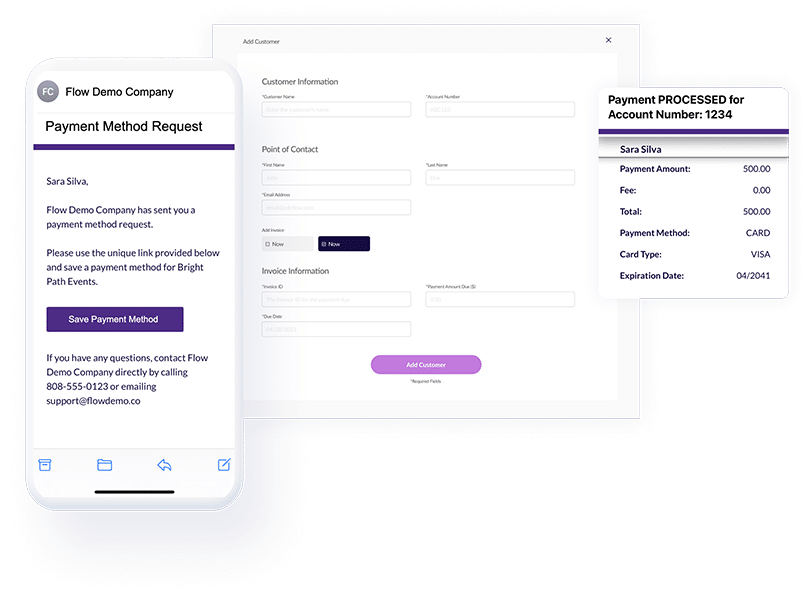

Flow Billing is a simple invoicing software from PDCflow that captures and stores payment data at the time a customer is added to the system. Flow Billing verifies that the payment details are valid, then encrypts and tokenizes details to keep the information safe.

On the date an invoice is due, the software automatically runs the transaction without the need for human intervention–no logging in to run a payment, no calling the customer for their credit card number and most importantly, no more late payments.