Share this Article

All office managers are looking for ways to save money and make operations run more smoothly. However, spotting ways to improve can be tricky. One overlooked area that can cut expenses is your payment management system.

The value of a good solution is hard to quantify just by the price tag. After all, efficiency in your processes can add up to a big savings in other areas of your business. That’s easy to overlook if you’re not paying attention. Here’s what your payment system should do to maximize efficiency in your office:

Reduce Your Staff's Manual Work Processes

One of the best ways to improve office operations is to minimize the menial tasks your staff has to do to keep the business running. By using accounts receivable automation to reduce manual work in your office, you free employees up for more important tasks. A few of the accounts receivable jobs your payment management system should be able to handle are:

- Automated Payment Reminders - Pick a system that sends out your payment reminders without a staff member having to remember or initiate them.

- Receive Digital Signatures on Recurring Payments - Look for a solution that can obtain a signature and payment together while on the phone with your consumer, reducing mail costs, delivery time and compliance headaches.

- Consumer Initiated Payment Methods - Online payment portals, mobile initiated payments, and automated voice payments through an IVR will allow payments to flow in 24 hours a day without a single employee spending time to process them.

Offer Omnichannel Payments

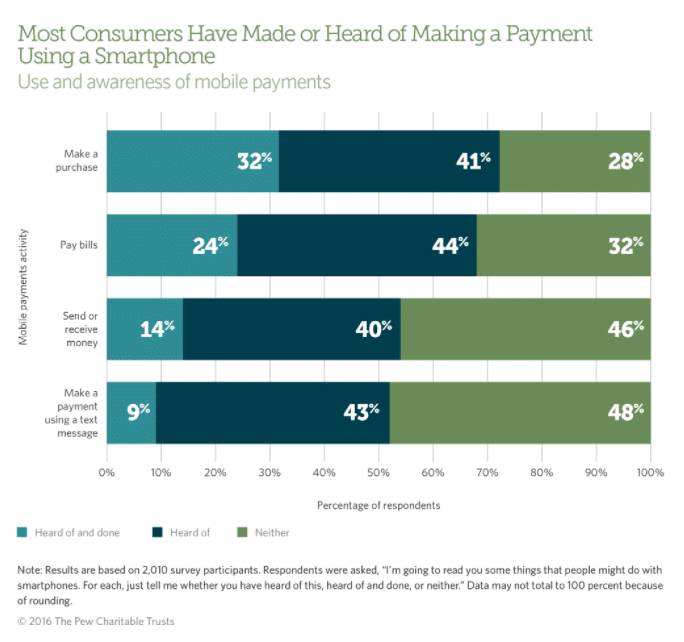

An omnichannel payment system is one of the best ways to increase revenue while making daily operations more efficient. It is important to provide ‘self-cure’ options to your customers along with new and traditional payment technologies. Consumers are becoming more reliant on technology for paying bills, so those who prefer self-cure options will jump at the chance to pay bills through a website payment portal, IVR system, text message or email.

Self-guided payments eliminate the need for your staff to take payments over the phone. The time saved by these convenient payment options can be used for higher-level tasks, or to serve customers that still prefer a human touch. Of course, the effectiveness of omnichannel offerings comes from also accepting multiple payment types. That way, you can offer the highest level of convenience to customers, which leads to efficiency within the office. A complete payment solution should provide you with:

- Ability to accept credit cards and ACH payments

- A user-friendly online payment portal

- An IVR payment option

- Pay-by-chat

- A mobile-optimized payment site

- A virtual terminal (so any computer can become a cashier station)

- Credit card swipers for in-person transactions

Omnichannel payment offerings take unnecessary work off your plate, and provide efficiency through positive customer interactions. Providing a payment option for everyone decreases the chance of dissatisfaction with the process. Any time your customers are happy, it reduces the amount of time staff spends addressing consumer complaints.

Offer Document Delivery with Payments

If your business provides bills or documents, or you must get a signature along with payment, look for a system that allows for delivery of a document or capture of a legal wet signature, and option to take a payment all in one product. With an electronic document delivery product, your office doesn’t have to wait around for items to be returned by mail. This allows you to send and receive payment authorizations within minutes -- not days or weeks -- as well as take a payment in the same workflow. With digital signatures and payments, your office controls the flow of revenue by speeding up the process and providing a frictionless experience to consumers.

Another perk of eSignatures is the paperless record-keeping that comes along with them. Going paperless makes storage and retrieval of items more convenient, so staff don’t need to spend extra time filing or retrieving paper records.

Automate Compliance Regulations

Trying to keep track of and properly follow payment regulations can slow down the payment process. Following regulations should always be a concern for your business, but choosing the correct payment processor can simplify policies and procedures drastically. Choose a payment management system that helps you comply with PCI, NACHA and Regulation E, without adding extra steps to the process. You need a payment solution that fulfills:

- Recurring Payment Necessities

- The solution should offer automatic sending of receipts (should the consumer wish to receive a copy for their records).

- The solution should send out payment reminders by text or email to fulfill regulations stated by both NACHA and VISA.

- Revocation Language Requirements

- A compliant solution will automatically display proper revocation language along with web payments to fulfill NACHA regulations.

- Secure Handling of Sensitive Card Data

- To fulfill necessities put in place by the Payment Card Industry (PCI), consumer card data must be handled and stored with extreme care. There are many components to PCI compliant payment processing. Be sure your payment processor understands their role.

Integrate with Office Software

If your payment management system won’t interact with your other office software, that can slow down daily tasks. Find a payment processor that offers open APIs with which your software can integrate. A payment processor that’s integrated into your existing office tools can provide automatic updates of payment transactions to your account management system. A good payment management software should provide developer integration support to make the integration process as seamless as possible.

Provide the Best Possible Consumer Experience

Does your payment management system make consumers find your website, create an account and E-sign terms and agreements? That’s a lot of friction. Don’t make consumers chase you down to complete a payment. Send payments to them. Remember, anytime consumers are happy, your job gets easier.

For more information on what to look for in a payment management system, download our Buyer's Guide.