Accounts receivable businesses have a unique relationship with consumers. Often, you find yourselves collecting a bill that consumers may not be excited to pay for a good or service that has already been delivered. Making payment as easy as possible will go a long way towards fast resolution and higher debt recovery rates.

Understanding the basic elements of how to improve customer experience is simple. What do consumers expect from other industries? What do you expect as a consumer in your own life? Convenience, positive interactions with staff, and intuitive, easy-to-use technology should all be elements of your accounts receivable customer experience strategy.

Why is Customer Experience Important?

Impacts of friction (especially on payments)

Friction is anything that may slow down how a consumer engages with your company. There are countless factors that can create or reduce friction with consumers. Identifying friction points in your company requires you to take a clear, objective look at every possible way you and your customers interact.

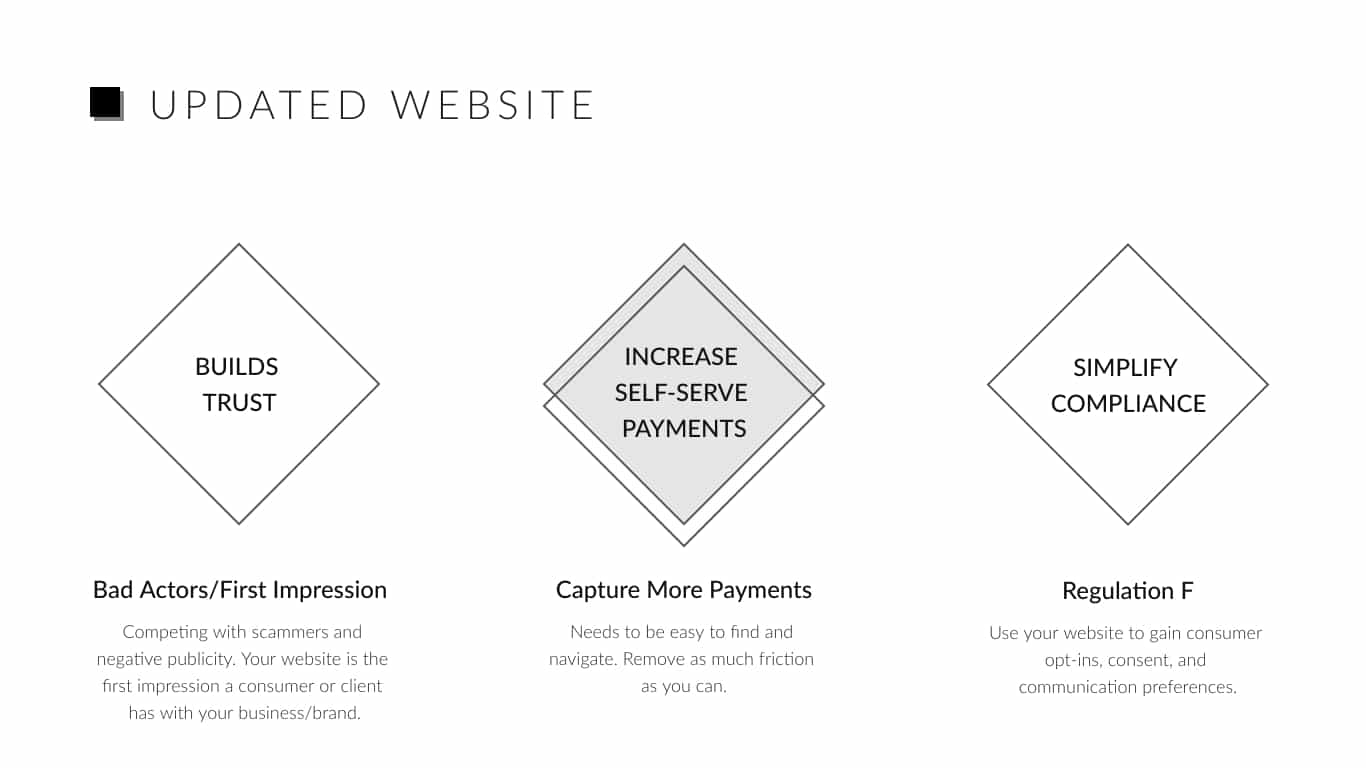

- Website visits - Your corporate website should accomplish a few different objectives simultaneously. It should build trust with first-time visitors through consistent branding and clear messaging. Your site should encourage self-serve payment to free up agents for more complex consumer issues. With the increasing popularity of email and text, your website should also simplify compliance by offering opt-in, consent and communication preference management. When executed properly, these objectives reduce friction and increase customer satisfaction.

- Live agents - Live agents are intended to make consumer interaction easier. You rely on them to practice conversational intelligence, gather all first consumer contactinformation necessary, and use positive language during calls. If these expectations are not being met, the friction caused by consumer dissatisfaction will make it harder to collect.

- Billing and payment procedures - Because the purpose of AR is to collect bills, most touchpoints with consumers center around payment. However, there are specific payment-focused friction points that should be avoided. Agents should have the tools to quickly guide consumers through payment while still adhering to PCI compliance – even when working remotely.

Keep in mind that reducing friction also requires you to understand the stages of a consumer’s journey when interacting with your business. Digital customer journey mapping can be a useful first step in understanding consumer behavior and knowing when roadblocks are causing payments to be lost along the way.

Customer Experience and Profitability

Companies know that happier customers are easier to deal with. In the past several years, surveys have even shown that the payoff of putting consumers first goes beyond reduced call escalations.

Many statistics demonstrate a direct relationship between making improvements to customer experience and seeing increased revenue within companies. There has also been evidence of an increased number of businesses that report competing on the topic of customer satisfaction. This means if your company makes the effort to reduce friction, you are likely to gain an advantage over competitors.

Consumers have also reported that when asked to rank what impacts trust, offering excellent customer service comes in at the top of the list. In accounts receivable – especially when collecting on behalf of a creditor client – gaining trust when collecting payments is an uphill struggle. Ensuring your consumers are satisfied creates credibility that makes account resolution easier and more effective.

How to Improve Customer Experience?

Updated website experience

An updated website is now an essential part of your business. To create a customer friendly website experience, look for solutions that:

- Build trust - Keep your website current. Using intuitive navigation and consistent branding and messaging throughout your website will create and build trust with first time visitors, recurring consumers and clients.

- Increase self-serve payments - Many consumers are now looking for fast, convenient ways to make payments. Offering online and other self-service payment options reduces the amount of time agents spend on the phone with consumers. This satisfies those who prefer no-contact billing resolution and frees up staff to handle more complex accounts.

- Simplify compliance - With the increase in email and text messaging for communication with consumers, using your website to manage consumer preferences will help you comply with Regulation F.

Positive first consumer contact

Oftentimes, the first consumer contact may also be the last. In order to move forward with resolving accounts, your staff needs to reduce friction caused by negative feelings from consumers. They also need to gain full and complete information for your records and further collection efforts.

And of course, all of this must be done while showing empathy for a consumer’s personal circumstances. Call center training and up-to-date call scripts can help you set and maintain expectations for agents to ensure they maintain a positive consumer experience.

Quick, easy payment resolution

If a consumer experiences friction or other poor service while paying, they are likely to abandon their payment or require you to expend more resources to collect a bill. In addition, your office must follow PCI compliance and ensure payment security is being followed in order to keep payment data safe – especially among remote workers.

To deliver convenience to consumers while still guaranteeing payment before the end of a call, agencies can use FLOW Technology. This payment communication tool reduces friction, speeding up payments, while ensuring credit card numbers are never handled by your agents.

When consumers opt in to email and text communication, FLOW can also be used to send payment reminders and payment requests to speed up resolution and improve the customer experience.

To learn more about reducing friction, standardizing workflows so consumers get consistently good service and increasing agent close rates on accounts, download this FLOW Technology Solution Brief.