Your staff works hard during the busy tax season and throughout the year to settle past-due accounts and collect payments for your debt collection agency. Without measures in place to prevent chargebacks, though, many of your payments could end up being disputed by consumers.

Agencies and other high-risk businesses can go months or years without experiencing the stress caused by credit card chargebacks. It can be as simple as following these chargeback prevention tips.

Common Chargeback Reasons

MERCHANT ERRORS

CRIMINAL FRAUD

FRIENDLY FRAUD

A friendly fraud chargeback can occur when the consumer initiates payment, but claims the payment should be refunded. This is often due to dissatisfaction with a product or service.

These chargebacks also take place when a consumer doesn’t recognize a company description on their statement after the fact.

💡 Chargeback Prevention Tip

If a staff member is taking the payment over the phone, follow a call script to ensure payment authorization is given. The script should require that staff members:

- Clearly state to the consumer how the payment description will appear on the consumer’s bank statement.

- Clearly state the cancellation policy, a customer service phone number, and hours they can call if they have questions about their payment.

- Use software that takes call center agents and telephone transactions out of PCI scope.

- PDCflow’s Flow Technology, allows agents to send a payment portal directly to a consumer while the agent is speaking with them. This way, the consumer can enter their payment information in private.

👉🏽 Learn more

Chargeback Prevention Management

Merchant service providers have designated a chargeback as a credit or debit transaction that is disputed by the consumer.

VISA requirements call for high-risk merchants like debt collection agencies to maintain a chargeback rate under one percent by amount and by volume. If not, you could lose the ability to accept credit and debit cards and may be blacklisted from getting another merchant account in the future.

💡 Chargeback Prevention Tip

How To Calculate Your Chargeback Ratio

You should review your merchant statement each month to determine whether you are keeping your chargeback ratio below one percent.

Steps to check that your total chargeback amount is under one percent:

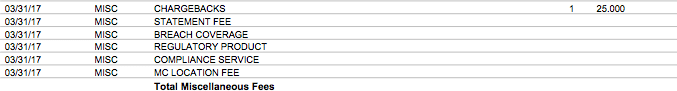

- Find the number of chargebacks incurred, which is usually found on a separate line item on your statement, along with the fee your MSP charges for each incident.

- Locate the total number of card transactions you processed for the same month.

- Divide the number of chargebacks by the total number of transactions, and you will have calculated your chargeback ratio.

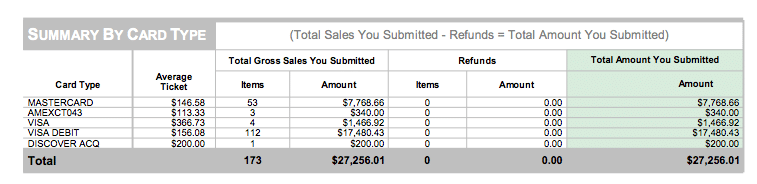

In the example statement below, the merchant processed 173 transactions and had one chargeback. Their chargeback ratio for the amount of chargebacks is .005 for this month.

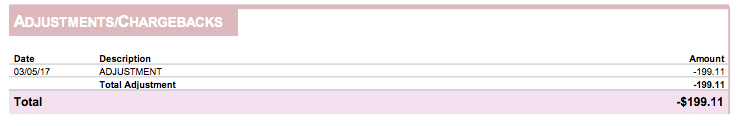

To calculate the volume-based chargeback ratio, you will need to divide the total combined amount of chargebacks by your total volume for that month.

In the example statement below, the merchant processed a total monthly volume of $27,256.01 and had a total dollar amount of $199.11 in chargebacks. So the chargeback ratio is .007 for this month.

💡 Chargeback Prevention Tip

How To Prevent Credit Card Chargebacks

CHARGEBACK PREVENTION FOR ONLINE PAYMENTS

Your credit card payment processing software should have online payment forms that contain some basic tools that reduce your risk of chargebacks, such as:

- Requiring address information on the payment form in order to use Address Verification Service (AVS).

- Requiring the consumer to enter the 3-digit code on the back of the card in order to use Card Verification (CVV2/CVC2).

- Be sure your payment software can send an automatic receipt via email if the consumer provides their email address. In addition, include your cancellation policy and a customer service number on your receipt.

- Your payment processor should allow you to add custom text to your online payment portal which clearly states your cancellation or refund policy on your website payment page and the receipt.

Some processors can require the consumer to check a box that they have read and understand the refund/cancellation policy before payment. In many situations, revocation language is also required.

💡 Chargeback Prevention Tip

CHARGEBACK PREVENTION FOR PHONE PAYMENTS

When taking phone payments, businesses put themselves at higher risk for data breaches, PCI compliance, and chargebacks. The best option is to use software that removes those risks so agents never see or hear payment information.

Software like PDCflow’s Flow Technology can help you prevent chargebacks by sending payment information to consumers along with authorization language, so you can collect an authenticated signature on every payment, while the consumer is still on the phone.

In addition, you can send payment authorization language in a Flow and require a consumer to sign, giving you permission to charge their card for a specific dollar amount.

Flow also makes it possible for a consumer to enter their own payment information and authenticate their identity, protecting consumers from credit card fraud. This secure communication workflow also makes it harder for people to fraudulently dispute payments.

CHARGEBACK PREVENTION ON RECURRING PAYMENTS

Recurring payments or payment plans set up with debit cards also fall under Regulation E requirements. Following these chargeback prevention tips will not only help you to avoid chargebacks, but will also keep you compliant with Regulation E.

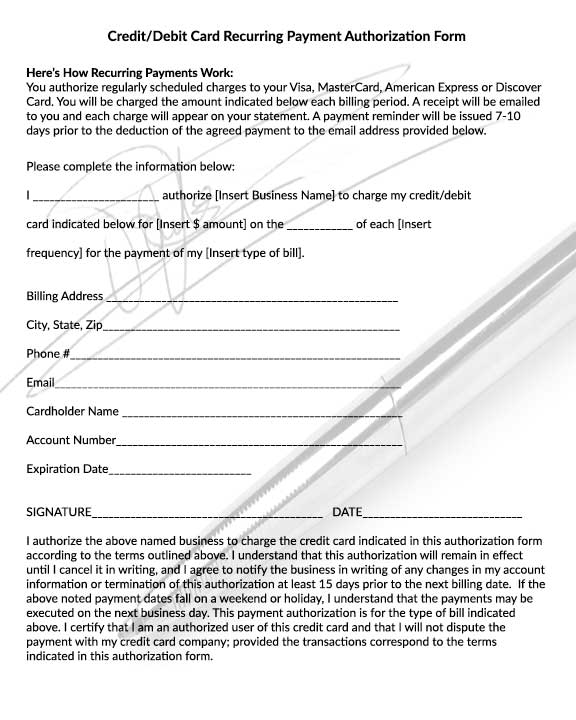

To meet Regulation E requirements for a payment plan set up with a debit card, your agent will need to get an actual or “wet” signature on the payment authorization. An adopted signature, unfortunately, does not meet the Regulation E requirements.

Instead, you may take the payment information from the consumer and fill it into a payment authorization form, as in the example below. In this scenario, you would have to mail the payment authorization form to the consumer and then wait for the consumer to either mail or fax it back.

Regulation E requires that this signed authorization be on file before the first post-dated payment is charged. This authorization must then be kept on file for two years following the conclusion of the payment plan.

Or, you can use a service like Flow Technology to send the payment schedule and payment authorization form in PDF format via text or email to the consumer.

The consumer can review the payment schedule, sign the authorization, and have it back to you in minutes. The sensitive card data is also encrypted with this type of tool to keep your agency within PCI Compliance regulations.

💡 Chargeback Prevention Tip

Reduce Chargebacks: Encourage Your Consumers to Contact You First

Make it clear to your consumers that if they have any questions about their payments, they should contact you first. Have your agents provide your customer service phone number while speaking on the phone, and be sure it is easy to find on your website and payment receipts.

If your consumer calls with questions, be sure to have someone available to answer them or call the consumer back as soon as possible. It is always better to issue a refund if needed than to have the consumer go to their bank and dispute the transaction.

Even if you win a customer dispute, a chargeback will still count in your chargeback ratio and you will be charged the fee listed in your merchant service provider contract (usually $25 or more).

Are you struggling with chargebacks within your business?

To keep your merchant account healthy, you need to understand what a chargeback is, how to calculate your chargeback rate, what actions will help you both fight current chargebacks and prevent them in the future, and use payment software that helps to prevent chargeback risk.

💡 Chargeback Prevention Tip

How PDCflow Software Reduces Chargeback Risk

PDCflow offers many features to eliminate the chance of chargebacks and help businesses win payment disputes as they come up. A few of the ways our software protects your company’s payments are:

Audit trails

The best way to protect your company is to prove customers have agreed to make the payments you are accepting. There are several ways to prove this:

Add dual authentication so customers have to enter a shared secret before accessing an email or text from your company. That way, messages are only opened by the intended recipient, to protect against fraud or privacy violations.

Text and email messages sent through PDCflow collect a date and time stamp, list the email and phone number of the recipient, and collect geo-location information. This shows they were the individual who initiated and completed the transaction.

Wet Signature

Wet signature is another term used to describe a legally binding signature. PDCflow payment authorization esignatures are legally binding, and create further proof that a customer meant to make their payment.

Card Verify

Online payment pages can sometimes attract fraud. PDCflow offers Card Verify to help companies make sure card payments are valid before they are submitted. Card Verify submits a $0 transaction before the real payment is submitted to prevent mistyped or fraudulent card numbers from being used.

AVS

Address verification is another marker that proves the correct customer is making a payment. PDCflow offers AVS verification to make sure customer address information matches a card number.

Automatic receipts

PDCflow automatically sends receipts to customers, so they don’t forget they have made a payment to your business. You can add a cancellation policy and customer service phone number on your receipt so that people who need to cancel a payment can do so through your company, instead of initiating a chargeback through their bank.

Custom text

Our online payment pages allow companies to add custom text, so you can add cancellation information and refund policies on the online payment page as well as your receipts. This is another way to drive customer concerns directly to your office, rather than through a dispute via a consumer’s bank.