Why Do Consumers Call Bait?

Call baiting is a fairly common situation your collectors are likely to encounter. While it is always done for one main goal – tricking your agency into making a debt collection compliance mistake – consumers may have many different motivations. “A lot of times they’re setting you up for an FDCPA lawsuit,” says Griffith. However, call baiters can have other motivations as well.

- Cease collection of the debt.

- Remove it from his/her credit report; and,

- Better credit score.

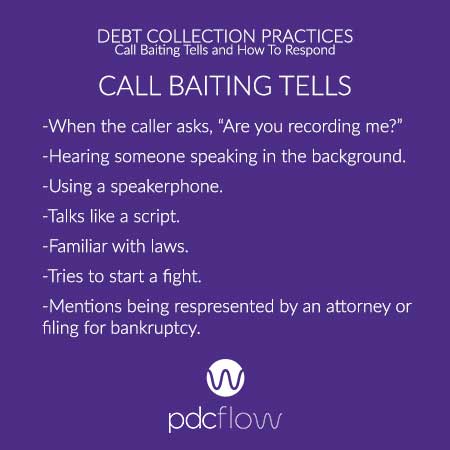

Seven Types of Call Baiters

1) Speaker phone

Consumers don’t always know what they need to say to bait collectors into a violation. In these situations, you may find them getting help during a call. If a consumer is using speakerphone during your call, listen carefully. This can be a sign that they have another person in the background giving advice.

Griffith says it’s best to fix the situation before it causes problems. She suggests training agents to politely request consumers get off speakerphone. One of the most effective tactics she’s seen firsthand is for a collector to mention a bad connection or background noise, politely asking the consumer to take their call off the speakerphone.

This tactic often works, but sometimes, consumers aren’t willing to do so. If politely asking doesn’t work, consider training collectors to end the call at this point. While agents hesitate to let consumers off the phone before payment, remember it’s better to stop a call baiting situation before your collectors make a mistake.

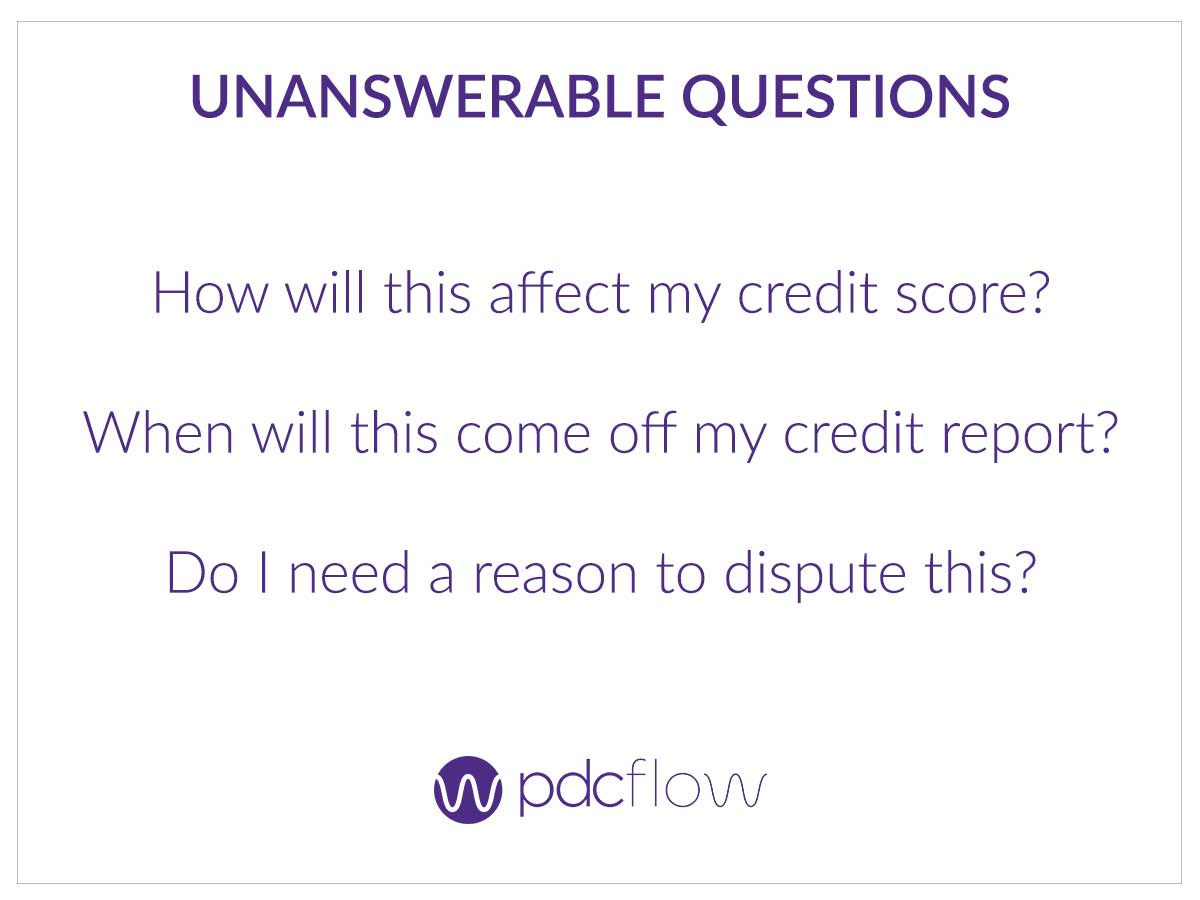

2) Unanswerable questions

Call baiters try to trip up collectors by asking questions you shouldn’t – or can’t – answer. Consumers will ask about credit, whether they will be sued, or other actions that differ case by case. Griffith says there are three main questions baiters tend to ask.

How will this affect my credit score?

There is no way to know what will happen to a consumer’s credit score based on a single debt. Many outside factors can impact credit scores. Train collectors not to answer this question or speculate about how many points might be added to a score after resolving a debt.

When will this come off my credit report?

Generally, there is a seven year rule for when items are taken off a credit report. However, an answer of seven years can be misleading. Griffith explains this could be viewed as seven years from the delinquency date, time of the collection call, date of service, etc. Because the answer may be considered misleading, it’s better to avoid giving one, instead driving the conversation back to the payment in question.

Do I need a reason to dispute this?

Consumers must follow specific steps to claim identity theft during a dispute. However, for any other reason that they disagree with the debt in question, they don’t need to offer a specific reason or take a certain action. Train your collectors to identify disputes early according to the guidelines your agency has in place.

3) Withdrawal of consent

4) Recorded conversation

5) Knows the laws too well

A consumer citing specific regulations, mentioning key phrases or being overly familiar with debt collection compliance laws may be a red flag. This indicates that they have done research online or have spoken to an attorney about what collectors can and cannot do.

Griffith suggests being especially mindful when speaking with these consumers. “The best way I’ve found is polite talk offs. You don’t want to agitate them.” However, she says some consumers become or remain upset regardless of how polite a collector may be. In these cases, remain calm and continue to drive the conversation back to the subject of paying their bill.

6) The resurrected debtor

This type of call baiting tactic is somewhat new. This tactic involves consumers your agency tried unsuccessfully to collect from in the past – sometimes years earlier – unexpectedly making an inbound call to you about their debt. Usually the baiting stems from discovering their old debt and becoming upset about it.

In the example given during her presentation, Griffith discussed a consumer who called in two years after the agency’s original attempts to collect, complaining about being contacted at work. In this type of situation, Griffith suggests asking for the number they don’t want to be contacted through, to have updated information in your system. This also ensures there weren’t calls made to that number in error.

During these situations, it’s best to avoid denial of the act consumers are accusing you of to avoid the risk of causing them to become more upset. For example, consider saying “I’m not seeing any calls to your work. We will flag the account for no further calls.” This type of response ensures you don’t acknowledge the negative action, but still confirms you will ensure it does not happen in the future.

“We need to make sure that collectors are trained to either talk these situations down or end the calls.”Amanda Griffith

7) The irate consumer

The FDCPA doesn’t regulate what consumers are allowed to say to debt collectors. Unfortunately, this can encourage people to abuse collectors, baiting them into a violation. Training debt collectors is the best defense against disrespectful baiters. Make sure your staff know in-house policies and procedures for escalating calls and handling irate consumers.

Griffith points out that we don’t always know what triggers our collectors may have. Have plans in place and properly train employees to remain calm and politely handle upset consumers – especially those who are baiting. As always, if the situation becomes too difficult, make sure agents know at this point it is best to politely end the call.

Train for Proper Handling

As mentioned above, training is the best way to avoid violations from call baiting. Two of the best ways to prepare collectors for call baiting situations are:

- Call recordings - Use real call recordings during your compliance meetings and training sessions. Picking call baiting situations that were properly handled will provide a real, solid example of how to identify future baits and teach staff the right way to handle them.

- Update scripts - Update all training materials regularly so staff have current materials to look at. Also, make sure these handbooks or reference materials are accessible to collectors.

- Discussions with front line employees - During training, have the front line collectors think critically about the examples you pose. Ask what the example collector did well and discuss how they would have handled the situation differently.

Most importantly, your debt collectors must know they should not make up answers. Let them know it is fine to transfer a call to a supervisor or politely end a call when necessary. These simple practices can help your company avoid litigation caused by call baiting scenarios.

For more examples of call baiting tells and how to respond to them, download our guide.

Download Call Baiting Questions: How to Respond

This article and the presentation upon which it was based are provided only as a general discussion of legal principles, theories and, idea. Every situation is unique and fact dependent. As this is not to be construed as legal advice, should you have particular questions, please consult with the licensed attorney to determine the appropriate application of the law to your particular factual scenario. No attorney-client relationship is formed by your attendance at the presentation or reading of this article. Berman Berman Berman Schneider & Lowary, LLP and PDCflow assume no liability for errors contained herein or for changes in the law affecting anything discussed herein.

Mrs. Griffith is licensed to practice in California and in the Ninth Circuit and, a partner at Berman Berman Berman Schneider & Lowary, LLP. She has extensive experience in litigation involving the defense of third-party collection agencies, creditor and, debt buyers and also works with agencies in varying capacities on compliance.