An organization’s billing process can depend on the goods and services offered and the audiences served. Your company should follow best practices based on industry but there will always be room to customize and improve workflows. Reviewing the billing tactics and tools your business uses will:

- Save money through more efficient processes

- Save staff time following up on unpaid invoices

- Increase customer satisfaction

Here are some billing process examples, the workflows they’re best for, and general best practices of invoicing and billing.

Collect on Delivery

The collect on delivery (or cash on delivery) model refers to collecting payment from customers as soon as work is completed or products or services are delivered.

B2B businesses like wholesalers often use COD billing, so they can get paid as soon as an order is fulfilled instead of waiting (sometimes months) for an invoice to be paid. This billing process:

- Lets your company set payment terms with customers before a large purchase, so they aren’t stuck with a surprise bill at the time of delivery.

- Guarantees payment will be made, as this model encourages merchants to collect payment data upfront.

- Simplifies the billing and payment process for both customers and staff. Customers don’t need to remember to take further action and employees don’t need to spend time reaching back out to remind people to pay.

What is a Credit Policy?

Credit Granting

Granting credit to customers allows people to make a purchase without cash on hand. This is a common tactic across many industries like manufacturing, consumer goods, and even in healthcare. Often, companies grant credit for expensive purchases or large B2B orders.

For example, a merchant will bill a customer for goods or services, giving them several weeks to pay. This model works well with recurring payment plans, so organizations can start bringing in cash sooner and customers aren’t pressured to come up with a large lump sum of money at one time.

Down Payments, Deposits or Retainers

For some small businesses, it makes sense to collect money upfront. For example, professional services like marketing, consultants or attorneys may require clients to pay a retainer at the time contracts are signed.

Manufacturers may also require a down payment on a large order. This gives companies some assurance of commitment. Customers who pay a portion upfront are more likely to follow through and pay for the order once it’s fulfilled.

Mixing Different Billing Processes

Depending on how diverse your offerings or customer demographics are, you may need to use several types of billing. Here are some other common ways to charge customers:

- Hourly billing - charges customers by the hour for the time you spend in meetings with them or completing work.

- Flat rate billing - charges a flat rate, no matter how much work it takes your company to create a product or complete service.

- Milestone billing - this billing model is used to charge customers once specific project stages have been completed.

Billing Process Best Practices

Billing typically refers to the entire process of calculating prices, creating a statement, sending an invoice to customers and collecting the money.

You can use different types of billing to manage customer accounts, like requiring payment upfront, granting credit, and offering recurring payment schedules.

No matter what type of billing model companies use, there are best practices that every organization should follow. These guidelines make paying easier for your customers.

Transparency

Transparent billing is essential for a good rapport and for creating a positive customer experience. Clearly state policies so customers aren’t surprised by your process.

This includes communicating your credit policies and procedures before purchase and making these documents available on your website. You should also communicate with customers any time there is a change in policy.

Consistency

Treat every customer the same as much as you can. Payment or contract terms can change but you should have set processes and a customer management system that lets you make the billing and invoicing easy for other teams to follow.

Ease of payment

Paying is never going to be a customer’s favorite part of a transaction. Making the process as simple as possible benefits everyone. Customers leave their interactions more satisfied with the experience and your company collects a higher percentage of your bills in a short period of time.

Some tactics for making payments easier are:

- Self-serve options - Let customers pay when they want through an online payment page.

- Digital payment communication - Send customers invoices and payment requests through email or text messages for easy access.

- QR codes - Make paper bills faster to pay by adding a QR code that takes customers directly to your payment page.

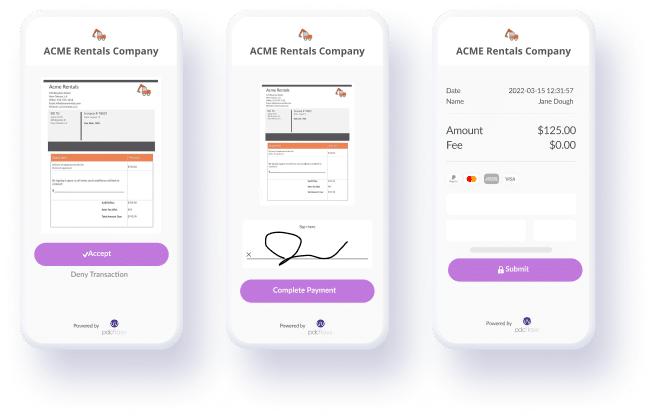

PDCflow for Simplified Billing Processes

PDCflow payment communication software can help companies save money, reduce staff workloads and enhance the customer experience. With PDCflow’s message delivery system, Flow Technology, organizations can:

- Use PDCflow to capture and store payment data ahead of time. This way, payments can be run as soon as an order is fulfilled – without storing the data within your system. This reduces company risk and PCI compliance scope and keeps customer data secure.

- Send a bill through SMS or email along with a payment request, so customers can view a statement showing what they owe along with a link directly to a payment page.

- Send contracts, work agreements or other documents to be signed electronically. Send a payment request along with documents to collect down payments or retainers at the same time.

- Create unlimited templates for flexible, customizable billing that allow you to manage your payments in the ways that work best for your company.

To learn more about how PDCflow can help you manage your billing processes, schedule a demo with a payment expert today.