Regulation F Implementation Challenges: Ask the Regulatory and Compliance Experts

The CFPB has set the implementation deadline of November 30th for Regulation F. Now, third-party collection agencies are working to ensure they have policies and procedures in place to be compliant by the deadline.

In this PDCflow sponsored webinar, Joann Needleman and Leslie Bender of Clark Hill Law took questions from attendees on the challenges they are facing as they prepare for this sea change in regulations.

Needleman and Bender discussed their readiness checklist for debt collection agencies and lead a live discussion on the most important elements to have in place before the rule’s deadline.

About the speakers

Joann Needleman

CLARK HILL LAW

Joann Needleman leads the firm's financial services regulatory and compliance practice and advises banks, financial institutions, and financial service entities on regulatory compliance matters.

A former member of the Consumer Financial Protection Bureau’s (CFPB) Consumer Advisory Board, Joann provides her clients with useful strategies and common-sense solutions in order to prepare for areas of regulatory scrutiny.

Leslie Bender

CLARK HILL LAW

Leslie C. Bender counsels financial services and healthcare clients on a broad range of privacy, data security, and consumer financial protection laws relying upon her strategic and legal experience as a general counsel.

As a corporate trainer, Leslie has more than 30 years of experience working with financial institutions, collection agencies, and as a compliance consultant and trainer for hospitals. Recognized as a national authority on information privacy and security law, she was one of the first privacy officers accredited by the International Association of Privacy Professionals as a Certified Information Privacy Professional.

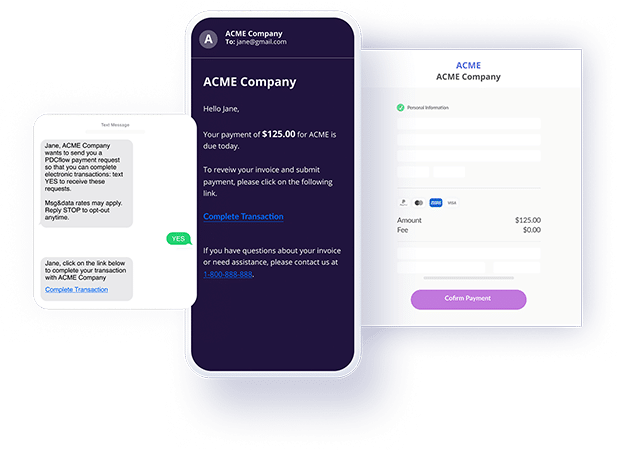

Continue learning about digital payments and security with PDCflow resources.

Create a better customer experience while protecting cardholder data.