Share This Article

The sudden change in daily life due to the coronavirus has businesses moving more operations online. Debt collection agencies are now working with remote staff or smaller teams, and are struggling with several state laws blocking collection activity. Agencies should now put a greater focus on good website design to make sure consumers can still make payments to, communicate with and learn about your business.

Basics of Good Website Design

If consumers are learning about your agency for the first time, or beginning to interact with you more fully through your website, they are going to expect the features they see elsewhere. If your website doesn’t contain the basic elements, you may struggle to gain consumer trust or lose them before they can take important actions like making a payment or opting into emails and texts.

- Brand Guidelines - Your company should establish branding guidelines that include color scheme, acceptable fonts, and other design elements. Follow these design guidelines on each page of the site to create consistency and a professional image. Some payment software offers customizable payment portals, so your colors and logo can be applied, providing continuity all the way through the payment process.

- Mission statement - Your agency’s mission statement can show consumers what is important to your company. Adding this statement to your website is another way to build trust with consumers and indicate your company’s objectives.

- Site Structure/Clear Navigation - Your website needs to be easy for users to navigate. If a consumer is coming to your site to opt-in to communications or to make payments, they shouldn’t struggle to find what they are looking for. Clearly mark where each page can be found and make it easy to get to these areas of the site. For ideas on how to make your website easier to navigate, consider reading the book “Don’t Make Me Think” by Steve Krug, or any other web design books that help you map out the optimal user experience.

- Mobile Friendliness - Many people access websites and make bill payments on their phones. If your website is hard to use on a mobile device, you might lose out on payments or consumer communications that could lead to revenue or account updates you need to know about.

- Search Engine Optimization (SEO) - SEO is what determines the sites that appear when your company’s name is searched online. When a consumer searches your company’s name, your website should be the first result, not a BBB complaint or other negative information. Using SEO keywords related to your company, you can better control your image and brand.

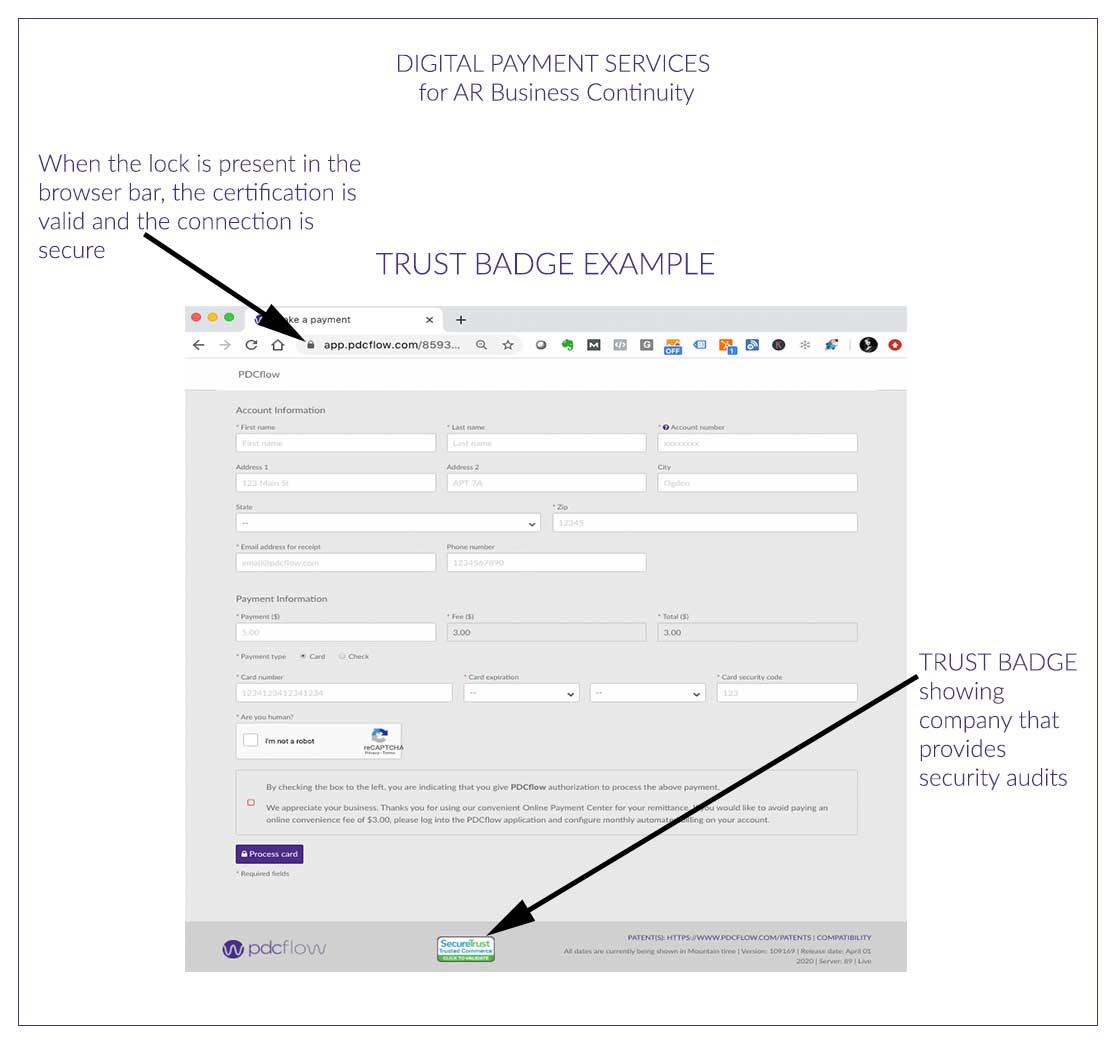

- Security - Your website – especially your online payment portal – should be secure. Part of good website design means using software that offers payment security, and also indicates this security to consumers so they know their data will be safe.

Collection-Specific Concerns

Once you understand the main points of good website design and have the basic elements taken care of, it’s time to think about debt collection-specific concerns. All debt collectors know the industry is unique and faces many challenges other businesses do not. Compliance is a huge concern, so don’t forget to factor this into your debt collection website design.

- Mini Miranda - It may be wise to place Mini-Miranda disclosures on one or more pages of the website.

- Privacy Statements - It’s important to have a robust privacy statement somewhere on your website so consumers know what data may be collected about them while using your website and communicating with your agents.

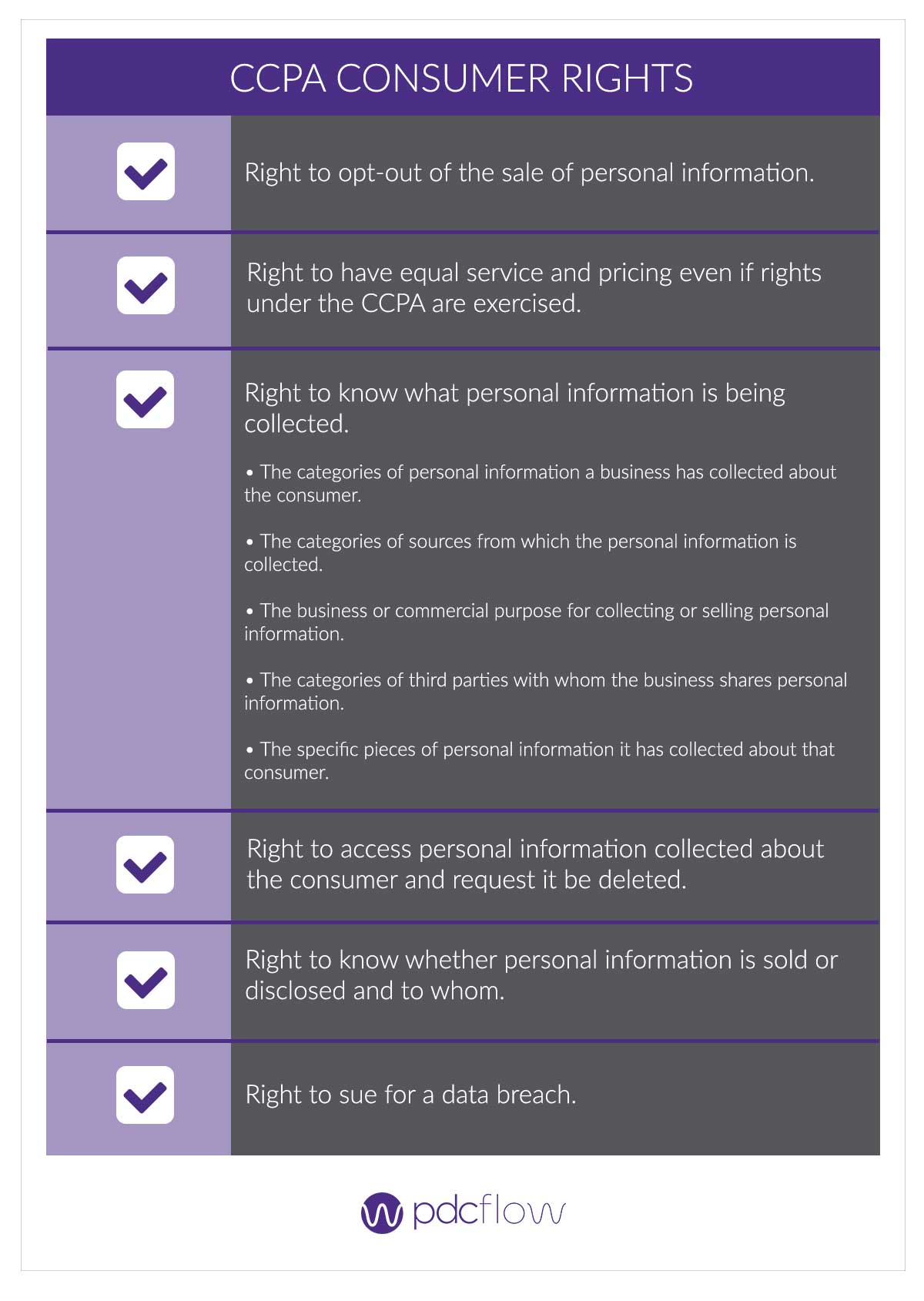

- CCPA Disclosures - For agencies that collect debts from California residents, the California Consumer Privacy Act (CCPA) may apply to your business. If so, you must provide all the CCPA compliant disclosures required by the regulation, and be prepared to accept requests from consumers concerning the data collected about them.

- Other disclosures - Depending upon the debts that may apply specifically to your type of collection (time-barred debt, etc.), there may be further disclosures that should be available on your website for consumers.

- Opt-Ins - Many consumers prefer to be contacted by text message or email. By adding opt-in forms to your website, they can make this choice and reach out to you. As with any aspect of your business, though, check with your agency’s lawyer to make sure any collection activities you intend to proceed with are still acceptable under the ever-changing state restrictions.

- Online payment portal - The current restrictions on debt collection are making it difficult to even settle accounts consumers want to pay off. Providing an easy-to-access payment portal can bring in self-cure payments. It also keeps payments secure while many agents are working from home and more susceptible to security issues outside of the controlled office environment. Be sure to place the payment button “above the fold” of your web pages (in the top half of the screen, where it can be quickly accessed). If the payment button is hard to find, many consumers will give up and abandon their plans to pay.

Use PDCflow Software to Optimize Your Website

PDCflow’s software offers solutions to the current industry challenges many agencies face.

- Customizable payment portal - Branded payment portals provide continuity with your brand and allow consumers to easily make payments without an outbound call.

- FLOW technology for secure text and email communications - For consumers who opt into text and email on your website or otherwise, FLOW technology can be used to facilitate communications with consumers that are more convenient than a phone call. Send payment reminders or payment requests and provide a secure form of payment that remote workers can facilitate while maintaining payment compliance.

- Secure Entry Overlay technology - Keep your data secure and reduce your PCI scope with our patented software that protects your business from a data breach.

For more information on building a debt collection website that reaches every audience, including consumers, download this how-to guide.